What is a budget?

A planned, itemized summary of money coming into the municipality and how that money will be spent over a specified period of time.

What is the Current (Operating) budget?

The operating budget pays for all the day to day activities of the corporation.

Examples of operating expenses include: salaries and wages, insurance, supplies, fuel, and utilities.

What is a Capital budget?

The Capital budget pays for all new, big investments or rehabilitation of assets currently under the city’s control.

Examples of capital expenses include: new buses, new roads, and new sewers.

What is Assessment Growth?

Assessment growth results from property taxes that are paid primarily as a result of an expanding City (new homes and businesses).

These new taxes are paid to receive the same services that existing tax payers receive. Given that there are an increased number of homes and businesses requiring core municipal services, civic departments, boards and commissions have to provide an increased volume of core services.

What are Reserves & Reserve Funds?

Reserves and Reserve Funds are established by Council, or statue, to assist with long term financial stability and financial planning. These funds are set aside to help offset future capital needs, long term obligations, and unexpected costs. They are drawn upon to finance specific purpose capital and operating expenditures as designated by Council, to minimize tax rate fluctuations due to unanticipated expenditures and revenue shortfalls.

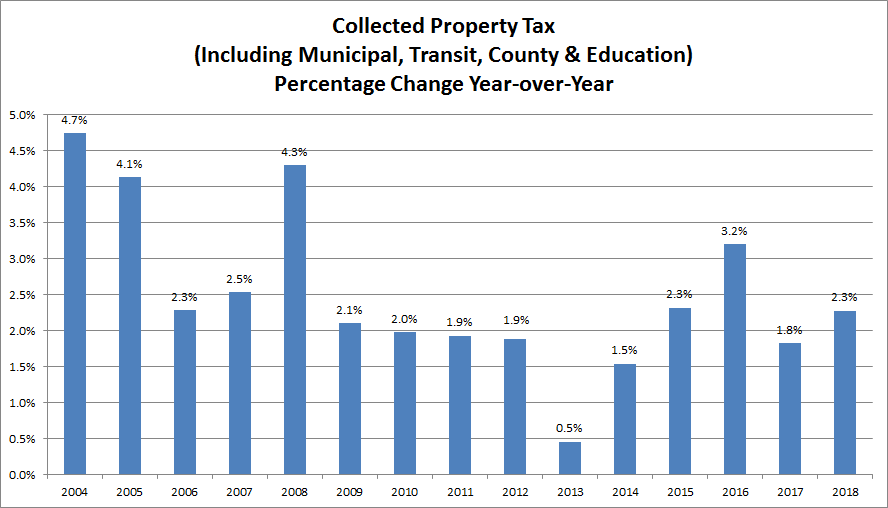

What is the percentage change in total property taxes changed over the years?

Taking into account the combined Education, County and Municipal/Transit taxes, based on all tax classes, the chart below shows the historical change (in dollars) collected through property tax from one year to the next.

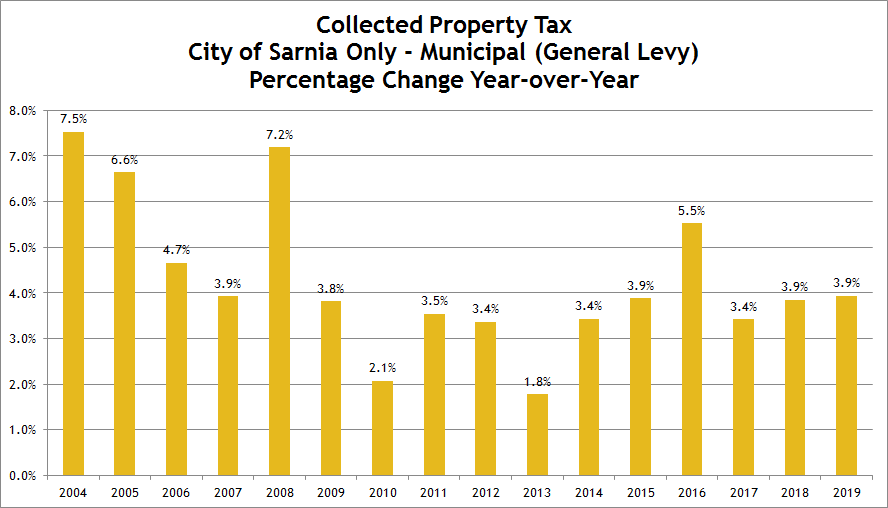

What is the percentage change in the Municipal portion of taxes directed to the City historically?

The chart below shows the historical change from one year to the next for the Municipal portion of property taxes only (General Levy). This is based on the City’s Council-approved budget.

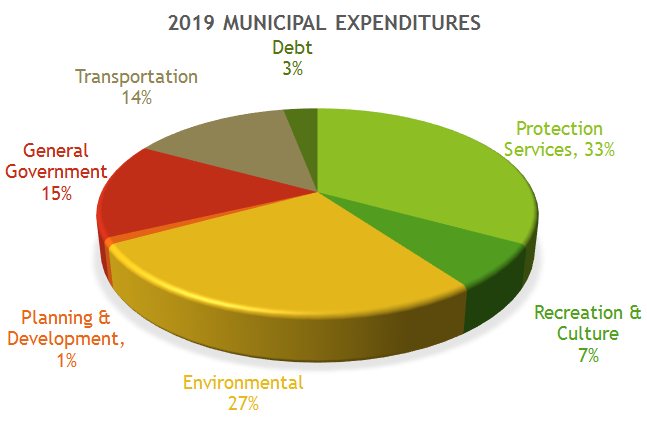

How is the City of Sarnia’s spending broken down between services?

The City’s total expenditures are allocated to services as shown in the chart below:

General Government: Council, Admin(Legal/ HR/Finance/IT/Clerk/Purchasing..), Economic Development, etc.

Protection: Fire, Police, Building, By-Law Enforcement

Transportation: Harbour, Engineering, Public Works, Transit, Parking Lots, Street Lighting

Environment: Waste & Recycling, Water, Sewer, Sanitary Sewers

Recreation & Culture: Parks, Recreation, Arenas, Library, Lawrence House, Strangway, Children’s Farm, etc.

Planning & Development: Drains, Planning, Committees

Debt: Principal & Interest Payments