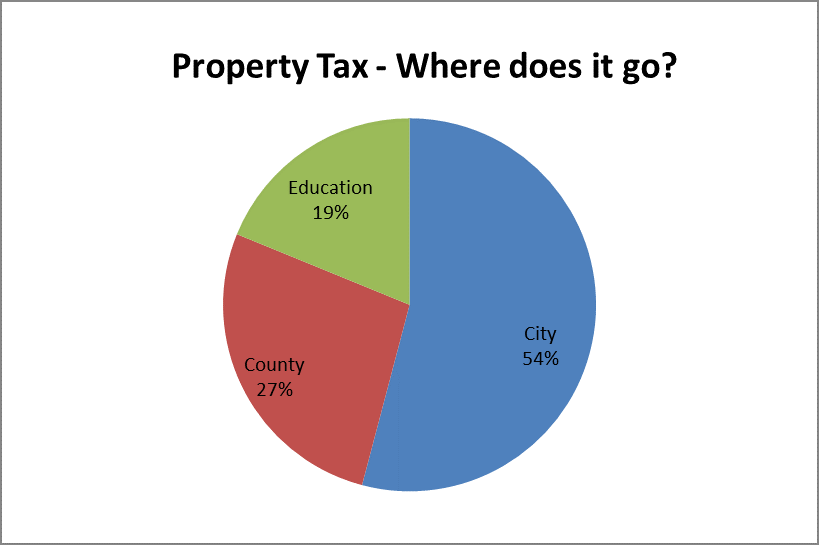

Your final property tax bill is made up of three main components:

1. Education taxes – This tax rate is set by the Province of Ontario and remitted to the local school board you support

2. Municipal taxes – The tax rate to cover the costs of supplying municipal services is based on city council’s adoption of our annual budget. Revenues from provincial grants, user fees and other sources are deducted from the total expenditures, resulting in a final amount that needs to be raised through taxation.

3. County taxes – A portion of the tax bill for all residents of County of Lambton goes back to the County to support their role in supplying various services including Ontario Works, Social Housing, Library and Cultural Services and Land Ambulance. How were my Municipal Tax dollars spent last year?

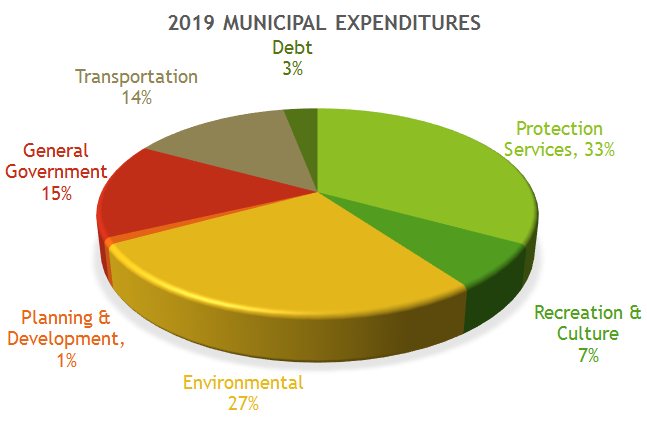

How were my Municipal Tax dollars spent last year?

General Gov’t: Council, Admin (Legal/ HR/Finance/IT/Clerk/Purchasing), Economic Development, etc. Protection: Fire, Police, Building, By-Law Enforcement Transportation: Harbour, Engineering, Public Works, Transit, Parking Lots, Street Lighting Environment: Waste & Recycling, Water, Sewer, Sanitary Sewers Rec & Culture: Parks, Recreation, Arenas, Library, Lawrence House, Strangway, Children’s Farm, etc. Planning & Development: Drains, Planning, Committees Debt: Principal & Interest Payments * Source: 2018 FIR Reporting by FIR category – based on 2018 Financial Statements Includes all expenditures (including Water & Sewer), with internal transfers removed