Tax Due Dates

2019 Interim Billing (All Classes) – Bills mailed first week of February

- 1st Installment: February 27, 2019

- 2nd Installment: April 29, 2019

2019 Final Billing – Bills mailed first week of June

- 3rd Installment: June 27, 2019

- 4th Installment: August 29, 2019

2019 Final Billing (Multi-Residential, Commercial, Industrial) – Bills mailed first week of August

- 3rd Installment: August 29, 2019

Payment Options

- Pre-Authorized Payment Plan – You can sign up for monthly automatic withdrawal, or automatic withdrawal on the tax due date. To sign up for our Pre-Authorized Payment Plan please complete and return the application form.

- In Person – Payments can be made in person in Customer Service at City Hall. Our business hours are Monday – Friday from 8:30am-4:30pm (excluding Holidays). Cash, cheque or debit are accepted.

- Online/Internet Payments – Using your 19 digit roll number, no spaces, decimals, or dashes. Search Sarnia (City) Taxes or Sarnia Tax to add as a payee. Please note that we do not accept Interact e-Transfers.

- Financial Institution – Payment can be made at most financial institutions. Please allow 2-3 business days for processing.

- Post Dated Cheques – Mailed or dropped off and held until due date.

- Mail – to Sarnia City Hall, Tax Office, 255 Christina Street North, PO Box 3018, Sarnia Ontario, N7T 7N2 (cheques only).

- Drop Box – located at the Christina Street Entrance (cheques only).

My taxes are paid with my mortgage

We are legislatively required to send the Final property tax bill. Your bill will indicate that your mortgage company has been provided with the information to make the payment on your behalf.

I am enrolled in the Payment Plan, why do I still get a bill every June?

We are legislatively required to send the Final property tax bill. Your bill will indicate that you are on the pre-authorized payment plan and includes a payment schedule.

Questions about my Assessment

Assessment-related inquiries should be directed to the Municipal Property Assessment Corporation (MPAC) located at:

1401 Michigan Ave., Unit 1, Sarnia, ON

Phone: 1-866-296-MPAC (6722)

TTY: 1-877-889 MPAC (6722)

Fax: 1-866-297-6703

Website: www.mpac.ca

What is my account number to add as a bill payment for online banking?

The roll number shown on your tax bill is the account number that you will need to use. Please remember no spaces, dashes or decimals.

What happens if my payment is late?

Penalty and interest are charged 15% per annum, applied the first business day of each month on all past due balances. Late payment charges are set in accordance with current legislation and cannot be waived. If payment in full is not received by the installment due date, a property tax arrears notice will be issued and a $5.00 fee will be applied. Failure to receive a bill does not excuse the home owner from payment responsibility.

Can I sign up for automatic payments?

Yes, you can sign up for our monthly pre-authorized payment plan. Download the Pre-Authorized Payment Plan Application Form below or contact us for more information. There is no cost to enroll in a pre-authorized tax payment plan.

Please refer to the Pre-Authorized Payment Plan Guidelines for additional information. Please note that pre-authorized payment plans are not transferable when moving within Sarnia.

To change banking information or to cancel a pre-authorized payment plan, please complete the Pre-Authorized Payment Plan Cancellation or Account Information Change Form. Notice must be provided prior to the 20th of the month in which the change is required. To make changes you can visit us, call 519-332-6309 or email us at taxes@sarnia.ca

How do I change my mailing address?

If the mailing address of your property is changing, please contact us to ensure the change is reflected on the City’s records.

How do I apply for a vacany rebate?

If you are a commercial or industrial property owner with a unit that has been vacant for at least three consecutive months, download and submit the Application for Commercial and Industrial Vacancy Rebate of Property Tax .

The deadline to apply is February 28th of the year following the taxation year to which the application relates

How do I apply for a registered charity rebate?

If you are a registered charitable organization renting space in a commercial or industrial property, download and submit the Application for Registered Charity Rebate Program.

The deadline for submitting an application is February 28 of the year following the taxation year to which the application relates.

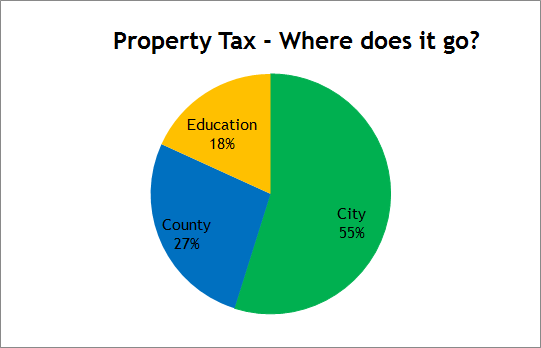

How are taxes divided?

Your final property tax bill is made up of three main components:

- Education taxes – This tax rate is set by the Province of Ontario and remitted to the local school board you support.

- Municipal taxes – The tax rate to cover the costs of supplying municipal services is based on city council’s adoption of our annual budget. Revenues from provincial grants, user fees and other sources are deducted from the total expenditures, resulting in a final amount that needs to be raised through taxation.

- County taxes – A portion of the tax bill for all residents of County of Lambton goes back to the County to support their role in supplying various services including Ontario Works, Social Housing, Library and Cultural Services and Land Ambulance.

Downloads

re-Authorized Payment Plan Guidelines

Pre-Authorized Payment Plan Application Form

Pre-Authorized Payment Plan Cancellation or Account Information Change Form

Application for Commercial and Industrial Vacancy Rebate of Property Tax

Application for Registered Charity Rebate Program